loose leaf books of accounts deadline

If you miss the deadline the penalty ranges between Php 1000 25000. Switching to loose-leaf books of accounts.

Revenue Memorandum Circular RMC No.

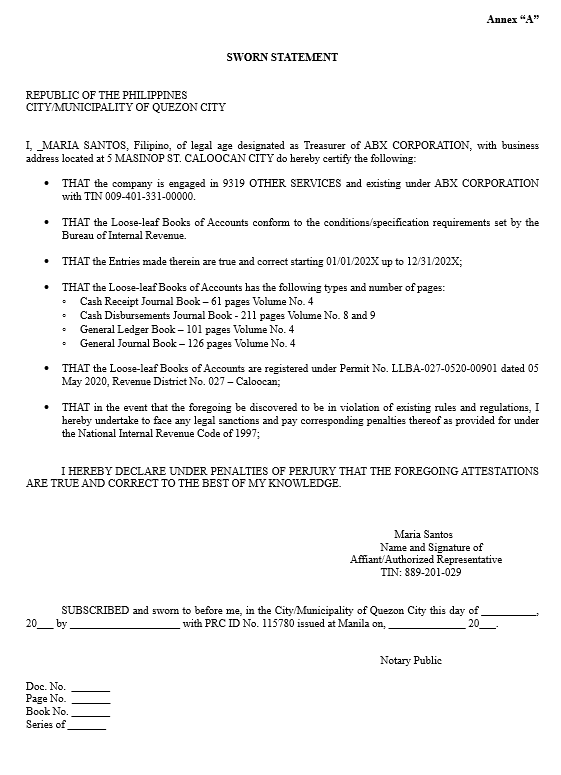

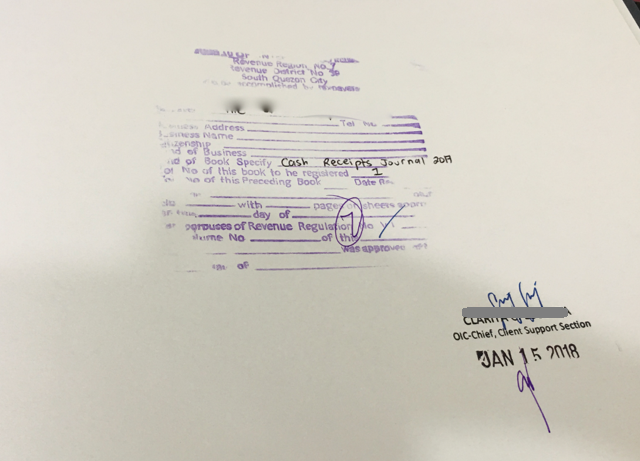

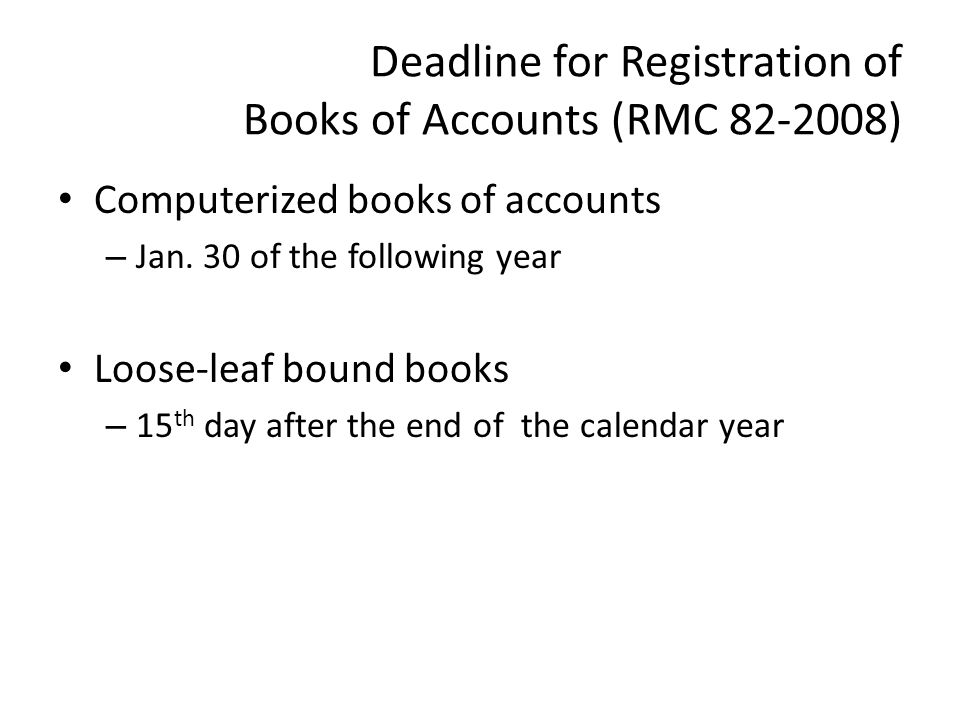

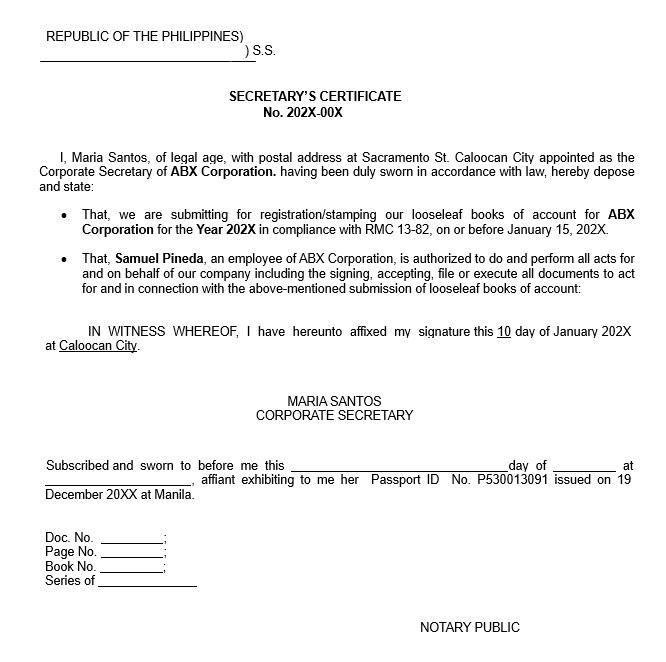

. Loose-leaf Books of Accounts For BIR approved loose-leaf books taxpayer must submit to the BIR bounded. 1 manual Books of Accounts. Registration of computerized books of accounts and other accounting records together with affidavit attesting the completeness of the computerized accounting booksrecords January 30 or 30 days after the end of the fiscal year.

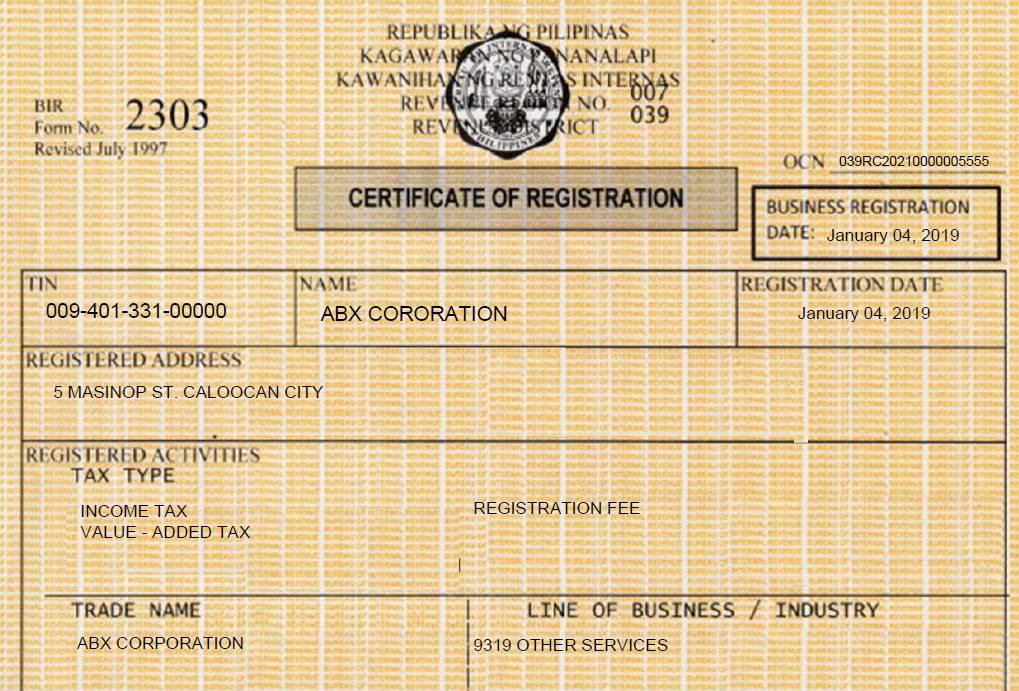

A Submit duly accomplished BIR Form 1905 at the RDO or concerned office under the Large Taxpayer Service having jurisdiction over the place where the head office and branch is located respectively. Payment Form Annual Registration. First there is an additional cost to print and cost to book-bind the loose leaf books.

An Ultimate Guide to Loose Leaf Books of Accounts. Second you need to submit the loose leaf books annually to the BIR RDO on or before January 15 of the following calendar year. Upon registration of Loose-leaf books of accounts the following are required.

Only the manner of recording has been adopted to electronic mode. Loose-leaf Books of Accounts. Lastly there is a stiff timeline to finalize your records and do all the other requirements before the BIR deadline for.

Application Requirements Deadline and Renewal. The deadline for filing the Loose-Leaf Books with the BIR is 15 January every year. January 15 or 15 days after the end of the fiscal year.

Thereof Loose - Leaf Books of Accounts 1901 Application for Registration For Self-Employed. Taxpayers may maintain theirits Books of Account in any of the following manner. For more information on Loose-Leaf Books in the Philippines including registration and annual filings check out our comprehensive Explainer on Loose Leaf Books of Accounts.

Any business that maintains its accounting books via the loose-leaf books of accounts. Registration of permanently bound computer-generatedloose leaf books of accounts and other accounting records. Loose-leaf Books of Accounts.

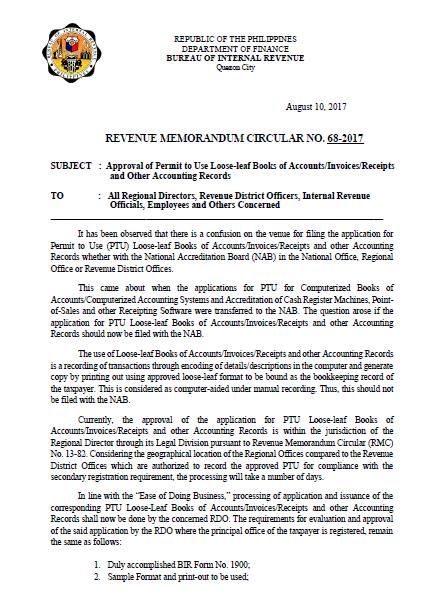

If I apply for a Permit to Use PTU in the middle of the year when do I start recording transactions using the Loose-leaf Books of Accounts. The manual Books of Accounts shall be registered before the deadline for filing of the first quarterly Income Tax. 68-2017 clarified that although the use of loose-leaf books is.

To address this BIR has issued RMC no 68-2017 to clarify that loose leaf bookkeeping is to be considered as a computer aided manual bookkeeping. BIR Form 1701 or 1702 and Audited Financial Statements. The deadline of payment for said documents is on or before April 15 although the summarization and preparation for external audit may already be started at year-end.

68-2017 Loose-leaf book is still manual event if it is created and printed using a machine. 2 loose leaf Books of Accounts with Permit to Use. According to Revenue Memorandum Circular RMC No.

There has been a bit of confusion on where the application for the PTU of loose leaf books of accounts should be filed. And 3 computerized Books of Accounts with Permit to Use. Loose Leaf Books Of Accounts 2022 Filing Permit To Use Loose Leaf Books Of Accounts Reliabooks Ebook Functional Assessment 4th Edition Pdf Ebook In 2021 Digital Textbooks Online Textbook Challenging Behaviors.

29-2019 which re-emphasized the way of keeping books of accounts the deadline for registration of the books the examination of the books and the retention period of accounting recordsNew to this rule is the registering of the books of accounts set prior to the deadline of filing the quarterly or annual income tax return and the examination of books if. What is RMC No. Accounting System or Components thereof Loose - Leaf Books of Accounts Description This form is to be accomplished by all taxpayers who intend to apply for authority to use either Loose-Leaf Computerized.

Deadline of Annual Payment of Business Registrations Renewal is January 20. You will need to print bind and submit your books of accounts that are generated from your spreadsheets or software to your respective BIR Revenue District Office RDO by January 15 of every year. Follow this guide so you can say goodbye to manual handwriting and hello to keeping your accounting records electronically.

Loose-leaf books of accounts and Computerized books of accounts. Digest Full Text. Do you reuse the papers you write for clients.

The deadline for annual payment of business registration renewal is every 20th of January. Meanwhile application for PTU Loose-Leaf is currently under the. After confirmation your paper will be delivered on time.

The deadline for the filing and payment of the annual ITR is the 15th day of the fourth month following the end of the taxable year. BIR Tax Deadline 15 Thursday REGISTRATION of Bound Loose Leaf Books of AccountsInvoicesReceipts and Other Accounting Records - Fiscal Year ending September 30 2020 SUBMISSION of List of. Deadline for manual filers.

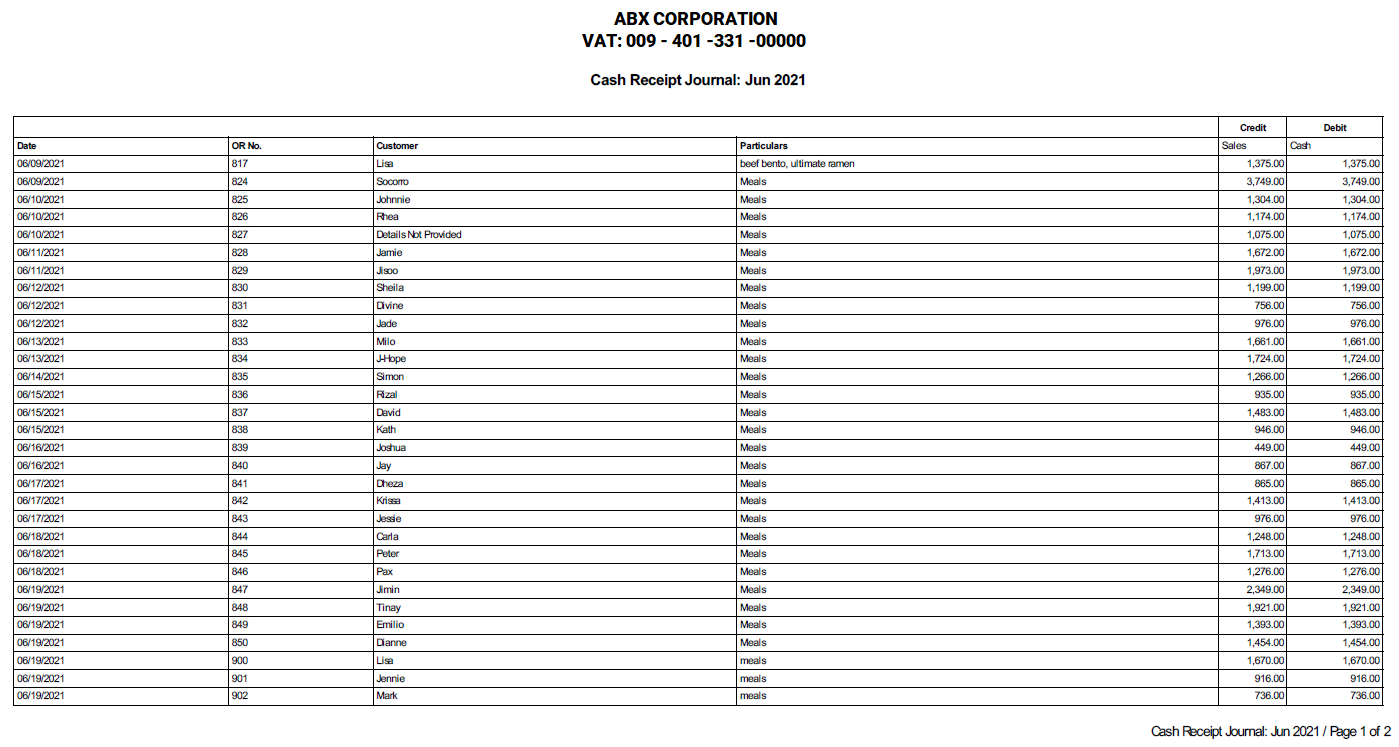

However a taxpayer has an option to renew their registration quarterly which is due every 20th day after the close of each quarter. To apply for BIR Loose Leaf a company must initially apply for a Permit to Use PTU Loose-leaf books of accounts with the BIR. The loose-leaf books of accounts is a recording of transactions through encoding of details in the computer and generating copies by printing this out using the approved loose-leaf format to be bound as the bookkeeping record of the taxpayer.

B Present the manualloose-leaf books of. Meantime cloud based accounting users can use loose leaf books of accounts. Loose leaf books of accounts deadline.

Loose-leaf Books of Accounts are still considered manual so there is no need to have a formal accounting system. Submission of Inventory List. For loose-leaf books of account the taxpayer shall maintain encoded details of the accounting records in the computer and shall generate copies in print using the duly approved format of the BIR.

However theres an option to pay the renewal registrations quarterly which is due 20 days after the close of the quarter April 20 July 20 and October 20.

Loose Leaf Books Of Accounts Annual Submission

Formats Of Books Of Accounts Explained

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts 2022 Filing

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Masyadong Bang Marami Ang Transactions Mo Monthly At Halos Sa Maubos Na Ang Oras Mo Sa Pag Bobookkeeping Manually Every Month Apply Na For Loose Leaf Bookkeeping Check Here The Steps On How

Updated Guidelines On Ptu Loose Leaf Filing Grant Thornton

Loose Leaf Books Of Accounts Annual Submission

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow

Bureau Of Internal Revenue Revenue District Office No 113 Davao City Ppt Video Online Download

What You Need To Know About Books Of Accounts Beyond D Numbers Consulting Co

Loose Leaf Books Of Accounts Annual Submission

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow

Loose Leaf Books Of Accounts Annual Submission

Bureau Of Internal Revenue Philippines Bir Tax Deadline 15 Saturday Registration Of Bound Loose Leaf Books Of Accounts Invoices Receipts And Other Accounting Records Fy Ending July 31 2020 Submission

Permit To Use Loose Leaf Books Of Accounts Reliabooks

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow